MEET THE TEAM

Corcapa 1031 Advisors

Christina Nielson

President

Christina Nielson is the President of Corcapa 1031 Advisors and has exclusively focused on Delaware Statutory Trust (DST) and Tenants in Common (TIC) investments for 1031 tax-deferred exchanges and Direct Investment programs since 2004. She works closely with national investor clients to find solutions which meet their investment objectives. Christina has helped investors purchase an approximate total of $100 million of securitized real estate and is a consistent top producer for her broker dealer.

Mark Koch

Senior Vice President of Due Diligence

Mark Koch is the Senior Vice President of Due Diligence and has been with Corcapa 1031 Advisors for over two years. He is tasked with analyzing and synthesizing all the data that comes with each DST, TIC and Direct Offering available to our clients.

Mark graduated with honors from California State Long Beach University in Communication Studies, competed in debate and also took many courses in computer science, math and physics. He worked full time throughout his university studies as both an internet salesperson and ultimately as a finance manager at Mercedes Benz of Long Beach where he learned about analyzing credit, negotiating with banks and meeting sales objectives.

Mark Koch has been an independent real estate broker licensed by California’s Department of Real Estate for over nine years. He has personally invested in over fifteen alternative real estate investments over the past ten years, allowing him an insider’s look into the sponsors and their performance. In his free time, Mark especially enjoys travel and landscape photography.

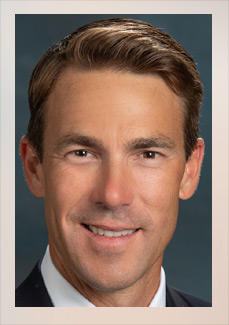

Rob Babcock

1031 Investment Consultant

Rob is a 1031 Investment Consultant with Corcapa 1031 Advisors and 1031 DST Solution. He is a General Securities Principal (Series 24) along with holding the Series 7, Series 63 and Series 79 registrations. Rob excels at helping investors navigate their 1031 journey while providing them with educational resources regarding DSTs, TICs and 721 UPREITs.

Mr. Babcock began his career in 1999 as a financial advisor for American Express. Over the course of the next 25 years, he worked as a vice president for several of the largest real estate sponsors in the country including 4 of the leading 1031 sponsors. Rob helped raise acquisition capital for over $20 billion in investments in nearly every major real estate asset class including multifamily, student housing, senior housing, lodging, retail, office, industrial, mineral rights and self-storage. For most of his career he has worked in a consultative role for hundreds of financial advisors helping them evaluate and incorporate real estate investments into their client’s portfolios.

Rob is a life-long Minnesotan never far from the water as he grew up on the shores of Lake Minnetonka before a brief stint in Watertown and more than 20 years in Stillwater. He currently splits his time between the St Croix River, (which forms the border between Minnesota & Wisconsin) and beautiful Balboa Bay in southern California. Rob enjoys boating, beaches, baseball, bonfires and barbecuing with his beautiful family.

Johanna Jacobsen

Operations Associate

Johanna Jacobsen is the Operations Associate at Corcapa 1031 Advisors. She competed in debate for four years which taught her how to think critically and on her feet. Being driven, motivated, and constantly striving for improvement, makes her a good asset to our team.

Johanna is originally from Sequim, Washington. Graduating high school a year early, she studied in Switzerland and Madagascar for eight months. She then moved to Costa Mesa in order to attend Vanguard University. Johanna not only enjoys the arts, but she also greatly enjoys anything involving the outdoors, especially hiking and climbing.

Whitney Harem

Operations Associate

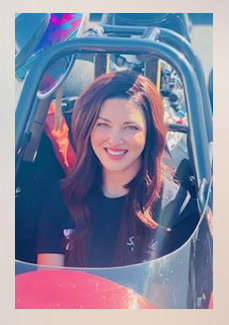

Michelle Na

Executive Administrative Assistant

Michelle Na is our executive administrative assistant and client experience manager at Corcapa 1031 Advisors since March 2022. She is an Orange County, CA native with over 18 years professional experience, previous positions include legal clerk, office manager, loan processing assistant, sales agent, and in property management. Michelle graduated from Cal State Long Beach with a BA in English, with a Rhetoric and Composition concentration. Her combined work experience and passion for helping is what drives her to continually provide excellent support for client service needs as well as internal operations management. At Corcapa 1031 Advisors, she prioritizes the clients along their 1031 journey from intake, understanding their goals, and managing ongoing communications. In her free time, she enjoys family dinners (both cooking and eating), taking care of her rescue dog, volunteering, DIY projects, and various wellness activities.

Corey M.

Chief Marketing Officer

Corey is the marketing and internet coordinator and SEO strategist at Corcapa 1031 Advisors. She oversees our online presence including digital marketing, web development, social media, search engine visibility and data analytics management. Corey is a native to Orange County and attended Cal State University Fullerton with a focus in graphic design and web development. Corey has been a part of the Corcapa team for 5 years.

Request 1031 Exchange Replacement Property Listings

To Receive a Listing of 1031 Exchange Replacement Properties Please Fill Out This Form

"*" indicates required fields