What Are the 1031 Exchange Rules in Montana?

Montana 1031 Exchange Rules and Guidelines

Are you interesting in learning more about the rules and guidelines of a 1031 exchange in Montana? Our comprehensive guide offers an overview of the 1031 Exchange process, 1031 Exchange guidelines in Montana, the benefits of a 1031 Exchange and common questions Montana investors ask when they are considering a 1031 Exchange.

The Internal Revenue Service (IRS) allows investors in Montana to defer capital gains taxes on the sale of business properties, rental properties, and land that was purchased for investment purposes through rules outlined in IRC Section 1031. This tax strategy is considered one of the most advantageous within the current tax code, offering Montana investors an opportunity to enhance their wealth accumulation through successive utilization of 1031 Exchange deferral strategies.

IRC 1031 is defined as: No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment.

What is a 1031 Exchange?

In order to qualify for a 1031 Exchange, the property that investors in Montana are selling and their prospective replacement property must fulfill certain criteria. Both properties must be held for use in a trade, business or investment. In addition, it is necessary that both the properties display sufficient similarity to classify as ‘Like-Kind.’

1031 investments can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or property that is not like-kind, however, you may trigger some taxable gain in the year of the exchange. There can be both deferred and recognized gain in the same transaction when a taxpayer exchanges for like-kind property of lesser value.

What is a Like-Kind Exchange?

A like-kind exchange is a tax-deferred transaction that allows for the disposal of an asset and the acquisition of another similar asset without generating a capital gains tax liability from the sale of the first asset.

Property types that are considered to be “Like-Kind” properties and are eligible for 1031 Exchange in Montana are:

- Multifamily Apartments

- Healthcare

- Self Storage Facilities

- Retail Centers

- Industrial Warehouses

- Student Housing

- Oil and Gas

- Agriculture/Farmland

Any Montana real estate held for productive use in a trade or business or for investment purposes is considered like-kind. It should be noted, a primary residence does not fall into this category, however, vacation homes or rental properties may qualify if they meet qualifying criteria.

What Types of Property Qualify for a 1031 Exchange in Montana?

Land, land improvements resulting from human effort including buildings and machinery sited on land and various property rights over the preceding (ex. homes, apartment buildings, shopping centers, commercial buildings, factories, condominiums, leases of 30-years or more, quarries and oil fields.) All types of real property are considered like-kind and thus exchangeable for all other types of real property in a 1031 exchange.

Farmland & Agriculture

Investors can 1031 exchange from farmland into residential multifamily properties or the reverse, where farm owners can sell farmland and reinvest proceeds into residential multifamily communities.

Delaware Statutory Trust (DST)

Investors can 1031 exchange from traditional property into DSTs of any type of asset class such as multifamily or self-storage.

Tenants in Common (TIC)

Investors can 1031 exchange into TIC ownership of properties in a variety of asset classes such as self-storage, Amazon or Costco tenanted industrial facilities, or even senior care facilities.

Oil and Gas

Investors can 1031 exchange from traditional property into oil and gas investments as working interests or royalty interests. We have had clients sell inherited royalty interest owned for decades and reinvest in income-producing multifamily properties.

Who Qualifies for a 1031 Exchange in Montana?

Owners of investment and business property may qualify for a Section 1031 deferral. Individuals, C corporations, S corporations, partnerships (general or limited), limited liability companies, trusts and any other taxpaying entity may set up an exchange of business or investment properties for business or investment properties under Section 1031.

Potential Benefits of a Montana 1031 Exchange

- Diversification

- Lower Minimum Investments

- No Individual Annual LLC Filings

- Potentially Greater Cash Flow

- Lower Risk

- Financing Access

- Non-Recourse Loans

- Larger Property Access

Types of 1031 Exchange Structures in Montana

SIMULTAMEOUS SWAP

To accomplish a Section 1031 exchange, there must be an exchange of properties. The simplest type of Section 1031 exchange is a simultaneous swap of one property for another. In order to successfully execute a Section 1031 exchange, there must be an exchange of properties. The most fundamental form of a Section 1031 exchange is a simultaneous swap of one property for another.

DEFERRED EXCHANGES

Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties.

To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case of a taxpayer simply selling one property and using the proceeds to purchase another property (which is a taxable transaction). Rather, in a deferred exchange, the disposition of the relinquished property and acquisition of the replacement property must be mutually dependent parts of an integrated transaction constituting an exchange of property. Taxpayers engaging in deferred exchanges generally use exchange facilitators under exchange agreements pursuant to rules provided in the Income Tax Regulations.

REVERSE EXCHANGE

A reverse exchange is somewhat more complex than a deferred exchange. It involves the acquisition of replacement property through an exchange accommodation titleholder, with whom it is parked for no more than 180 days. During this parking period the taxpayer disposes of its relinquished property to close the exchange.

Montana Clawback Provision

A Section 1031 tax-deferred exchange, as stipulated by the Internal Revenue Code, enables property owners to postpone the recognition of capital gains taxes that would otherwise be incurred upon the sale of business or investment properties. This deferment can extend indefinitely until the investor opts for a “cash-out”, or conducts a taxable transaction by acquiring non-like-kind assets such as cash or other ineligible properties.

Typically, capital gains taxes are only applicable in the state where the final property transaction occurs. Nevertheless, certain states adopt distinctive stances which may subject taxpayers to potential double taxation. Currently, states including California, Montana, Oregon, and Massachusetts enforce these clawback measures. Contact Corcapa 1031 Advisors to learn more about the clawback provisions in Montana.

Receive a Free Initial Consultation from a Qualified 1031 Advisor

Want to learn more about the 1031 Exchange Process and how to defer capital gains taxes with a 1031 Exchange? Contact us for experienced guidance.

Steps to Complete a Montana 1031 Exchange

1. CONSULT

Speak with your financial and tax advisors before selling your property to make sure a 1031 exchange is right for you.

2. FIND A QUALIFIED INTERMEDIARY (QI)

Choose a QI before you close escrow. They will hold your exchange proceeds during the transaction process. Do not take receipt of funds – all proceeds must go to the QI or 1031 is invalidated.

3. CHOOSE REPLACEMENT PROPERTY

You have 45 days to “identify” replacement property, and 180 days to close on the relinquished property.

Corcapa 1031 Advisors specializes in locating like-kind replacement properties at equal or greater value for full tax-deferral.

4. DEBT OR NO DEBT?

The IRS requires matching the debt from your relinquished property with equal or greater debt in the replacement property.

Don’t need debt? You can buy properties with debt or without.

Debt always brings some risk to real estate ownership, but can provide the benefit of increasing depreciable basis and sheltering some cash flow from taxation.

5. PROCESSING & PAYMENT

After you select your replacement property, Corcapa 1031 Advisors prepares your purchase documents and sends them to you for signature. Next, sign paperwork with your QI releasing your sale proceeds to the escrow account.

6. RECEIVE DISTRIBUTION

After you’ve closed on the replacement property, cash flow distributions are typically made monthly and deposited directly into your bank account.

What are the Time Limits on 1031 Exchanges in Montana?

In a like-kind exchange, it is not mandatory for the swap of properties to occur simultaneously. However, it is imperative to adhere to two specific timing restrictions. Failure to meet these deadlines will result in the entire gain being subject to taxation. These time limits are strict and cannot be extended under any circumstances or hardships, with the sole exception of those occurring during presidentially declared disasters.

The first limit is that you have 45 days from the date you sell the relinquished property to identify potential replacement properties. The identification must be in writing, signed by you and delivered to a person involved in the exchange like the seller of the replacement property or the qualified intermediary. However, notice to your attorney, real estate agent, accountant or similar persons acting as your agent is not sufficient.

It is imperative that replacement properties are meticulously detailed in the written identification. For real estate, this specification should include a legal description, street address, or a distinct name. Adherence to IRS regulations regarding the maximum number and value of properties allowable for identification is essential.

The second limit is that the replacement property must be received and the exchange completed no later than 180 days after the sale of the exchanged property or the due date (with extensions) of the income tax return for the tax year in which the relinquished property was sold, whichever is earlier. The replacement property received must be substantially the same as property identified within the 45-day limit described above.

The 1031 Exchange Solution E-Book

Utilizing DSTs and TICs for passive, diversified, real estate investing.

Download our FREE 1031 Exchange E-book that provides valuable information on tax-deferred exchanges, 1031 Exchange guidelines and a step-by-step guide on how the 1031 Exchange process works.

The 1031 Exchange Solution E-Book

Utilizing DSTs and TICs for passive, diversified, real estate investing.

Download our FREE 1031 Exchange E-book that provides valuable information on tax-deferred exchanges, 1031 Exchange guidelines and a step-by-step guide on how the 1031 Exchange process works.

Montana 1031 Exchanges FAQs

Learn more about the 1031 Exchange process and common questions about 1031 Exchanges.

A 1031 Exchange is a transaction in which a taxpayer is allowed to exchange one investment property for another by deferring the tax consequence of a sale. The transaction is authorized by 1031 of the IRS Code.

Contact a Corcapa 1031 Advisor for more information 1031 Exchange process and if it is right for you.

How do I complete a 1031 Exchange?

To accomplish a full tax deferral on the sale of rental property you must follow the IRS Section 1031 Guidelines. Corcapa 1031 Advisors recommends the following:

- Be in communication with your Corcapa 1031 Advisors representative well ahead of your proposed relinquished property sale closing date so we can begin to research and identify potential replacement property.

- Be sure to select and assign a Qualified Intermediary “QI” or Accommodator to receive the sale proceeds from escrow. Corcapa can recommend QIs for you. Be sure to research the financial backing of QIs before selecting them. Be especially careful to NOT take personal receipt of the funds or your exchange will be invalidated.

- From the day you close your relinquished property, you will have 45 days to identify your replacement property(ies). This identification must be in writing, and can follow one of three possible identification rules:

- 3-property rule: Up to three properties are identified no matter what their value.

- 200 percent rule: Any number of properties is identified as long as their combined fair market value (FMV) does not exceed 200% of the FMV of the relinquished properties.

- 95 percent rule: Any number of properties are identified no matter what the aggregate FMV, provided 95% of the value of the identified properties is acquired.

- The investor must close on the identified replacement property(s) within 180 days from the close date of the relinquished property. This is an additional 135 days from the end of the 45 day period in which to close on your replacement property(ies).

- Additionally, for full tax deferral you must purchase equal or greater purchase price, equal or greater debt and reinvest all cash.

- Please review the IRS publication here for further details: http://www.irs.gov/uac/Like-Kind-Exchanges-Under-IRC-Code-Section-1031

Does a 1031 Exchange Have to Be in the Same State?

No, 1031 exchange do not need to be in the same state. Like-kind exchanges are recognized and can be completed in all 50 US states.

It is important to recognize that although the majority of states conform to Section 1031 of the Federal Internal Revenue Code concerning 1031 exchanges, certain state-specific regulations do exist. Notably, states including California, Massachusetts, Montana, and Oregon have implemented claw back provisions. These provisions mandate that any appreciation in property value that occurs within these jurisdictions is subject to state taxation, irrespective of whether the property was subsequently exchanged for another in a different state.

To effectively navigate the varying regulations across states, it is advisable to consult with an experienced alternative investment specialist who can guide you through the intricacies of a 1031 Exchange.

How Does a 1031 Exchange Work in Montana?

The fundamental concept of a Montana 1031 Exchange aligns with the national standard. If you own real property that is used in your business or held for investment purposes, engaging in a sale may qualify you to defer federal and state income taxes normally due on such transactions.

Utilizing a 1031 exchange strategy allows for this tax-deferral. Essentially, it enables the seller to divest of their property and reinvest the proceeds into another ‘like-kind’ property, adhering to specific time limits established by law. This strategic approach offers significant financial benefits under appropriate circumstances.

What is a DST?

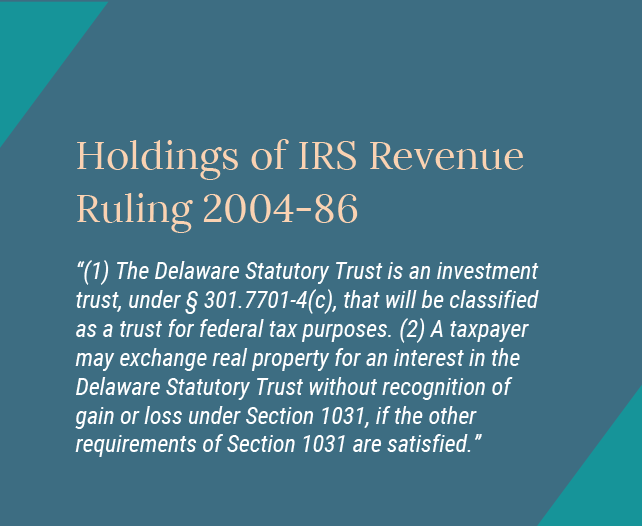

A DST is an acronym for a Delaware Statutory Trust which is fractional ownership of real estate. In 2004 the IRS issued a Revenue Ruling clarifying the terms on structuring a DST investment for 1031 purposes. Please review the IRS Revenue Ruling 2004-86

Will a DST or TIC Qualify for a 1031 Exchange?

The Revenue Ruling 2004-86 issued by the IRS governs how the DST should be structured so that the real estate program is likely to fit within the guidelines of a 1031 exchange. TICs have a Revenue Procedure 2002-22 that discusses the 15 structure points TIC programs should have in order to receive a “should level” tax opinion. Corcapa 1031 Advisors works with sponsors of DST and TIC offerings who structure the offerings with a legal opinion from experienced industry attorneys for 1031 exchange purchases. We recommend that you discuss this with your tax and legal advisors and we will provide all documentation to these advisors to use in analyzing your replacement property options.

Why do investors Choose DSTs for 1031 Exchange Properties?

The most common reasons that investors select Delaware Statutory Trusts are:

- Potentially Greater Cash Flow Than They Are Currently Receiving: Most DSTs have between a 4.00% – 5.50% projected cash flow based on the anticipated rental income less expenses. For example, if you invest $1,000,000 of equity into a DST with a 4.5% projected cash flow, this would provide a projected net annual income of $45,000. This could be a higher net cash flow than you are currently receiving on your rental property. As with all real estate the income cannot be guaranteed because the rental income and expenses can increase or decrease unexpectedly.

- Ability to Diversify: You can reinvest your relinquished property sale proceeds into multiple investments in different cities, states, and asset classes such as apartments and net lease retail.

- Non-Recourse Loans: Virtually all the loans within the DSTs that are approved by DAI Securities, LLC are non-recourse which means the investor does not personally guarantee them.

- Easier Financing: Access to financing for investors needing debt on their replacement property

- Passive Ownership Structure: Many investors desire to reduce their active property management as they grow older and DSTs offer passive ownership.

We recommend that all clients review each PPM in detail and consult their tax and legal advisors to full understand the benefits and risks of the investment. Corcapa 1031 Advisors is happy to attend a meeting with your tax and legal advisors or have a conference call to answer all questions.

How do you report Section 1031 Like-Kind Exchanges to the IRS?

You must report an exchange to the IRS on Form 8824, Like-Kind Exchanges and file it with your tax return for the year in which the exchange occurred.

Form 8824 asks for:

- Descriptions of the properties exchanged

- Dates that properties were identified and transferred

- Any relationship between the parties to the exchange

- Value of the like-kind and other property received

- Gain or loss on sale of other (non-like-kind) property given up

- Cash received or paid; liabilities relieved or assumed

- Adjusted basis of like-kind property given up; realized gain

If you do not specifically follow the rules for like-kind exchanges, you may be held liable for taxes, penalties, and interest on your transactions.

Are you an Accommodator?

While Corcapa is happy to refer you to accommodators, we cannot provide accommodator/Qualified Intermediary services. We specialize in the replacement properties for our clients’ 1031 exchanges.

* All information provided on this page is time sensitive and subject to change

Finding the Right Investment Specialist for Montana 1031 Exchanges

Corcapa 1031 Advisors are 1031 exchange and alternative investment specialists that help investors diversify their portfolio with alternative real estate investments and 1031 Exchange Replacement Property. We exclusively focus on investments for 1031 tax-deferred exchanges.

Our qualified 1031 exchange specialists help Montana real estate investors diversify their financial goals through alternative real estate investments in the form of like-kind replacement properties that meet their investment requirements, defer taxes and grow wealth.

Qualified Montana 1031 Advisor

President of Corcapa 1031 Advisors, Christina Nielson, has over two decades of experience specializing in 1031 Exchange Replacement Property and tax-deferred 1031 exchanges in Montana and throughout the United States.

Christina works closely with Montana investors to find solutions which meet their investment objectives. She has helped investors purchase an approximate total of $100 million of securitized real estate and is a consistent top producer for her broker dealer.

“I have personally completed over 400 fractional real estate transactions in excess of $400,000,000 in my 20 year career – making our firm one of the premier 1031 exchange into DSTs and TICs firms in the United States. We have clients in 27 states.”

Christina Nielson

Corcapa 1031 Advisors President

Why Choose Corcacpa 1031 Advisors?

With over a two decades of experience specializing in 1031 Exchange Replacement Property, we help clients in Montana and nationwide meet their investment objectives.

- We Have Hundreds Of Successful 1031 Exchanges

- We Provice A Free Real Estate Portfolio Analysis

- We Provide A Free Initial Consultation and Proposal

- We Provide Current 1031 Exchange Property Listings

- Non Recourse Loans -- Can Close In 3 Days

- We Have Dozens of Client Referrals

Browse 1031 Exchange Property Listings

Get Access to Replacement Properties for Your Montana 1031 Exchange

REQUEST LISTINGS

Prospective clients can complete a quick form to receive current 1031 exchange properties.

BROWSE PROPERTIES

Once approved, you can login anytime and view current 1031 Exchange properties.

1031 ADVISOR GUIDANCE

Our qualified team will provide guidance and recommendations based on your investment goals.